Sound Familiar?

Manual Data Entry?

Manual data entry is time-consuming, error-prone, and can lead to inefficiencies in insurance compliance management, hindering management.

Inefficient Remedial Work Management?

Dealing with follow-up remedial works, such as addressing defects and recommendations identified by insurance inspectors, without automation can result in delays, operational inefficiencies, impacting compliance and posing challenges in coordinating actions for insurance compliance.

Fragmented Insurance Compliance Data?

Fragmentation makes it challenging to have a complete overview of insurance compliance statuses, hindering reporting and regulatory obligations.

Limited Real-Time Monitoring?

Making it difficult to track performance, assess risks, and respond promptly to potential issues and insurance inspections.

How Can True Compliance Help?

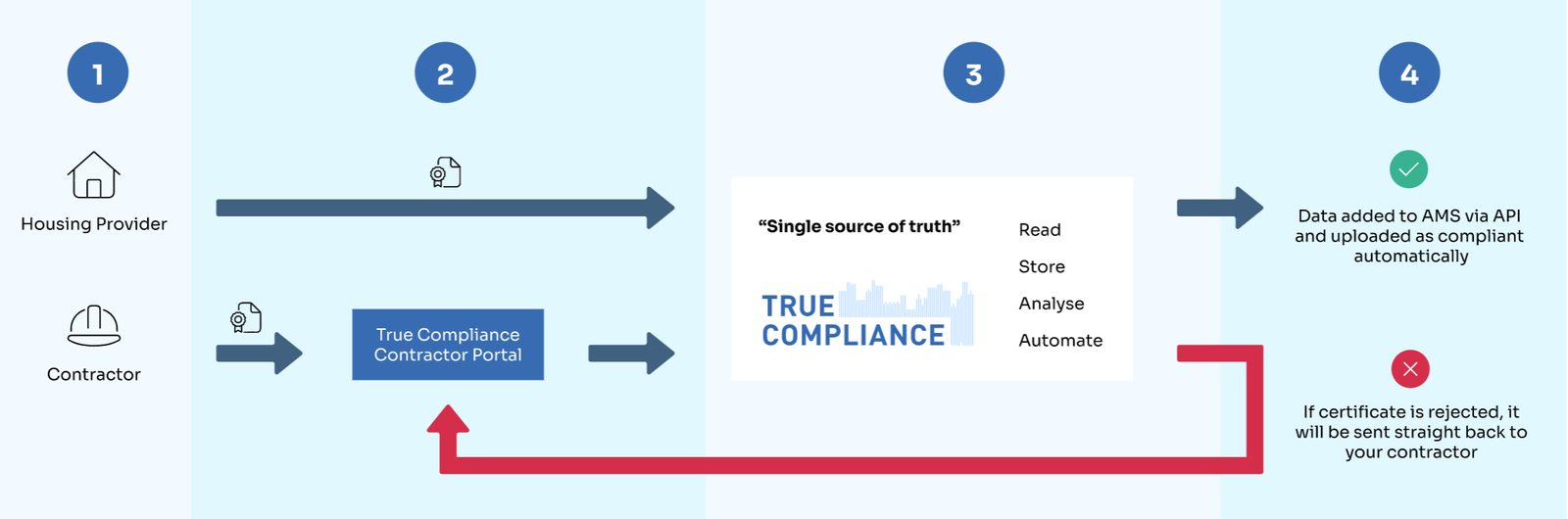

- Automated Data Entry: True Compliance automates data entry, reducing manual work, minimising errors, and streamlining insurance compliance management, enhancing efficiency and accuracy.

- Automated Remedial Work Management: True Compliance automates the management of follow-up remedial works, ensuring timely responses to defects and recommendations from insurance inspectors, leading to operational efficiency and compliance.

- Centralised Insurance Compliance Data: By centralising insurance compliance data, True Compliance provides a comprehensive view of compliance statuses, simplifying reporting and ensuring compliance with regulatory requirements.

- Real-Time Monitoring: True Compliance offers real-time monitoring, allowing for immediate performance tracking, risk assessment, and timely responses to insurance inspections, increasing safety and operational efficiency.

Key Features

Centralised Management

True Compliance offers a smart and highly configurable system that consolidates all your insurance compliance needs in one place. This includes managing insurance inspections for various components such as LOLER, lifts, playgrounds, and pressure vessel compliance or servicing. By centralising these processes, True Compliance simplifies your compliance management and improves your assurance.

PPM and Insurance Inspection Alignment

True Compliance automatically synchronises your planned preventative maintenance (PPM) schedule with insurance inspections, making it easy to track and manage both concurrently. This alignment optimises your maintenance efforts and ensures you don't miss critical inspections.

Efficient Action Extraction and Allocation

True Compliance streamlines the process of handling insurance inspection actions. It automatically extracts each individual action and allocates them to the right staff members, teams, or contractors based on the rules you've defined for each specific action requirement. This automation reduces manual work, speeds up response times, and ensures the right personnel handle the necessary tasks.

Comprehensive Action Management

True Compliance allows the user to collect, store, and track evidence of activity related to each action resulting from your insurance inspections. You can add notes, attach documentary evidence, or include photographic documentation to support the completion of these actions. This feature enhances accountability, transparency, and audit ability in your compliance management process.

Trusted in partnership with housing organisations across the UK

Insurance Inspections FAQ's

LOLER places the duty of regulatory compliance upon the owners, operators or people with control over lifting equipment. All lifting operations must be properly planned, appropriately supervised and carried out in a safe manner, with documentation evidencing this. True Compliance enables you to safely store and easily access all relevant compliance

documentation in one centralised location, whilst also reminding you of key deadlines such as renewal and expiration dates.

Yes, True Compliance allows users to collect and store evidence of activity against actions resulting from Insurance Inspections. This can include notes, documents, or photographic evidence to support the completion of these actions.

Yes, True Compliance is a cloud-based solution that enables it to be well-supported with real-time updates. This ensures that the compliance platform that you are using is up to date, helping to protect your tenants whilst also keeping your properties compliant.

True Compliance offers real-time reporting for Insurance Inspections. Users can access dashboards and dedicated reporting tools to monitor the compliance status, identify areas of concern, and track performance against set targets or Key Performance Indicators (KPIs).

Yes, LOLER certificates can be stored on our online compliance platform. Our tools will automatically extract the pertinent information such as renewal dates, helping you to stay compliant with LOLER.

LOLER stands for The Lifting Operations and Lifting Equipment Regulations 1998.

The frequency of Insurance Inspections can vary based on the type of equipment or facility. Generally, inspections should occur annually, but specific requirements may differ based on the equipment and local regulations.

LOLER is a set of regulations which covers the safe operation of lifting equipment. It is designed to reduce the health and safety risks of people using the lifting equipment by ensuring a set safety standard is adhered to.

Common assets and equipment subject to Insurance Inspections include lifts, heating systems, electrical installations, pressure vessels, fire safety equipment, playgrounds, and more. The specific items can vary depending on the property's features and local regulations.

LOLER only applies to lifting equipment that is used at work. Some lifting equipment, in particular continuous types that transport people from one level to another are often not considered lifting equipment so are not subject to the specific provisions set out within LOLER.

Examples of equipment that requires a LOLER inspection:

- Passenger lifts

- Goods lifts

- Scissor lifts

- Cherry pickers

- Dumb waiters

- Many more...

Compliance management software allows housing providers to store records, certificates, and evidence from Insurance Inspections securely in a digital format. This ensures accurate record-keeping and easy access when needed.

A LOLER inspection will involve a thorough examination of the lifting equipment by someone defined by the Health and Safety Executive (HSE) as a ‘competent’ person. This LOLER inspection can also be referred to as an insurance inspection. The inspection is to ensure that the equipment is safe for use and operation.

Yes, it is illegal for lifting equipment to operate without a current and in-date LOLER certificate.

; ?>)